impossible foods ipo australia

I sincerely doubted anyone was cold calling me for anything that was a good idea and definitely not anything thats going to be profitable for me so basically just hung up. Mushroom-based meat brand Fable Food and plant-based burger marker v2food are some of the existing players.

Impossible Foods Eyes 2022 Ipo Amid Heavy Demand Market Values

Asked onstage how Impossible Foods will get the money to achieve its goals as a company and if that meant an IPO was coming soon the exec agreed that yes.

. Impossible Foods is set on going public. Impossible Foods latest funding round gave it a valuation of 403 billion in. Like most of the 150-plus employees at the Silicon Valley headquarters of Impossible Foods David Lee often partakes of the vegan breakfast and lunch served daily in one of the companys quirkily named meeting rooms Ketchup Narwhal Zeep.

Based on current and expected growth trajectories Impossible Foods could reach 900 million in annual revenues during 2022. The move follows positive news from the countries joint food standards agency as it passes the use of a key ingredient in the companys alt-meat. Please send me emails about Impossible Foods products and services.

But Lee isnt vegan. The stock still trades below its IPO price of 35 per share. Stock exchange through an IPO or SPAC listing Forbes reported.

Ad Access Late-Stage Tech Firms. Titled Turn Back the Clock Impossible Foods 2020 Impact Report opens in a new tab opens with an intimate retrospective on how the top. Food tech giant Impossible Foods is now advertising for a new Australia and New Zealand Country Manager role on LinkedIn suggesting that the firm is gearing up to roll out its plant-based.

Impossible Foods IPO got my details from CommSec apparently. He islike the companys target customera self-described hard-core meat eater. If Im located outside of the United States I consent to my information being transferred to Impossible Foods in the United States.

Impossible Foods has already announced its plans to go public in the US with a US10 billion IPO. Impossible Foods does have hugely ambitious goals that require a lot of resources. Im Australian and I was cold called by someone sounding Philipino.

REDWOOD CITY Calif USA -- In a new report published today at Web Summit 2020 Impossible Foods is serving up fresh insight on COVID-19s extraordinary impact on the companys operations and workforce. Impossible Foods has sued fellow foodtech player Motif FoodWorks for patent infringement in one of the highest-profile intellectual property IP disputes to date in the burgeoning alt-protein space. The much-anticipated introduction of its famous heme-filled patties in the fast-growing plant-based market in Australasia comes amid talks of its US10 billion IPO.

By Sally Ho Published on Nov 8 2021 Last updated Nov 6 2021. Tech Crunch recently interviewed Impossible Foods executives about the potential of a near-term IPO. Dacmo on 17112021 -.

Buy Impossible Foods Stock After it Begins Trading. Alt Protein Future Foods. It brings the US companys total funding close to 2 billion according to a press release and values the company at 7 billion according to reports.

Buy Impossible Foods After the Impossible Foods IPO. Consent is not a condition of purchase. It is a direct rival to the US-based firm Beyond Meat.

The announcement comes amidst rumors of the companys USD 10 billion IPO plans via a SPAC special purpose acquisition company merger. But its not going to the public. Impossible Foods has secured 500 million in a new funding round led by existing investor Mirae Asset Global InvestmentsOther existing investors unnamed at this time also participated.

As Impossible Foods readies itself for a reported 10 billion public listing in the next 12 months the alt-meat giant looks set to cause serious market disruption with an upcoming launch into Australia and New Zealand. Impossible Foods is reportedly looking to raise 500 million in a new funding round that would bring its valuation to 7 billion. One such company Impossible Foods Inc is reportedly planning to enter Australia New Zealand markets soon.

135 billion Base Estimated Gross Total Return. A salesmultiple of 18x is used for a bull scenario 15x for a base scenario and 12x for a bear scenario though investors. Plant-based protein titan Impossible Foods is reportedly looking to go public on the US.

While most competitors dont use synthetic ingredients to create their plant-based products Impossible Foods is solely focused on the genetic modification of ingredients and proteins to make fake. The reports come as the Silicon Valley food techs founder and. There are three ways you may be able to acquire shares of an IPO stock such as Impossible Foods.

It wont be before the end of the year and it may not be until the tail end of the recent food IPO. Impossible Foods Eyes 7B Valuation Founder Hints At Inevitable IPO. He said he was part of Vantage Investments which I cant find as a currently trading company in AU and he would send me an email about an IPO for Impossible Foods the company is valued at billions.

Impossible Foods eyes 7B valuation for inevitable IPO. In its complaint filed yesterday with the US District Court of Delaware Impossible Foods alleges that Motif which was spun out of Massachusetts-based. Impossible Foods sues startup Motif Foodworks over meatless burger patent.

He already knew my full name which he claims he got from a survey I took earlier in the year from my. Robinhood Shares Look Attractive After 67 Post-IPO Plunge By Haris AnwarInvesting. Impossible Foods is an alt-meat company planning to foray into the Australian and New Zealand market.

Buy Impossible Foods Stock in the Initial Public Offering IPO Attempt to Acquire Impossible Foods Stock in Pre-IPO Secondary Marketplaces. US plant-based meat giant Impossible Foods is advertising for a role in Australia suggesting the company is making its long-awaited entry into the local market. Please send me emails about Impossible Foods products and services.

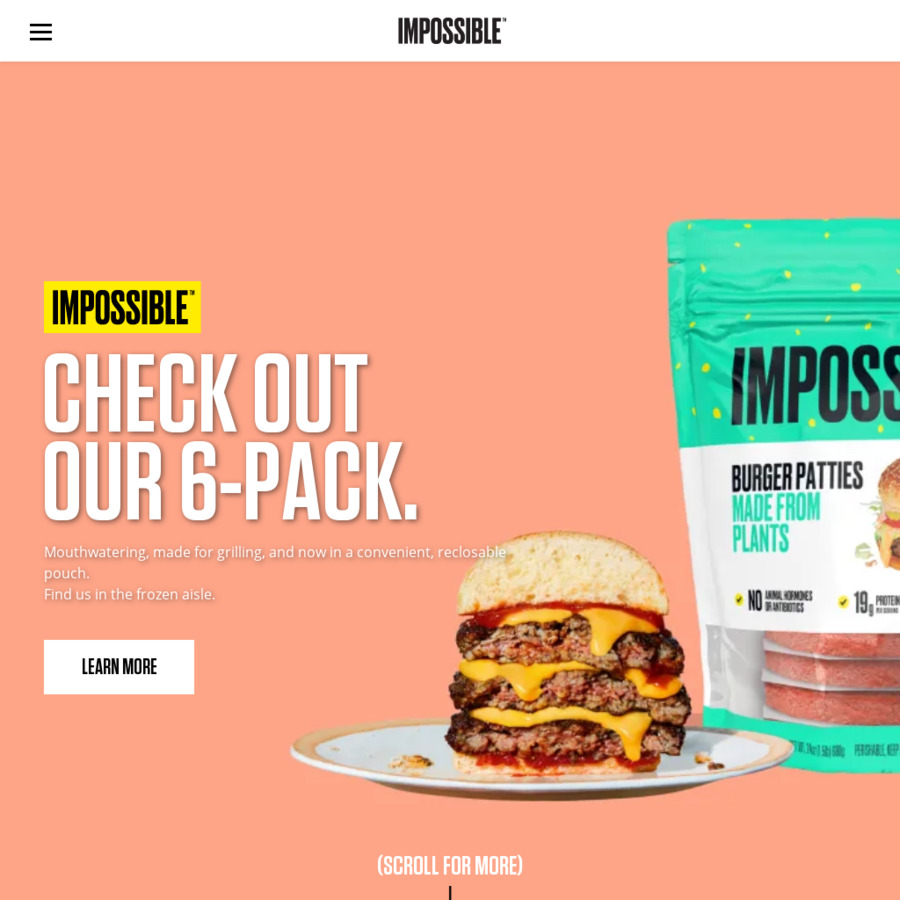

WeWork wound up being exposed as junk before its IPO. Although there is currently no date set for the filing the California company is in talks to raise 500 million at a valuation of 7 billion. Impossible Foods is a plant-based meat manufacturer or agri-food startup which uses molecular research to create realistic substitutes for meat dairy and fish.

Impossible Foods Launches In Supermarkets In Hong Kong Singapore Inside Retail

Impossible Foods Eyes 7b Valuation For Inevitable Ipo

Australia S Proform Foods Announces Strategic Investment From Harvest Road Vegconomist The Vegan Business Magazine

Impossible Foods Ipo How Soon Can You Buy The Vegan Company S Stock Youtube

Exclusive Impossible Foods In Talks To List On The Stock Market Sources Reuters

Impossible Foods Raises 500m On Road To Possible Ipo

Beyond Meat Uses Climate Change To Market Fake Meat Substitutes Scientists Are Cautious

Impossible Foods Is Coming To Australia Here S What Lies Ahead Inside Fmcg

Pin On Fw 22 23 Visionary Reciprocity

E U Says Veggie Burgers Can Keep Their Name Published 2020 Veggie Burger Burger Veggies

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Impossible Foods Ready To Launch And Disrupt In Australia Ahead Of 10 Billion Ipo Vegconomist The Vegan Business Magazine

Exclusive Impossible Foods In Talks To List On The Stock Market Sources Nasdaq

A Few Surprises From Linkedin Alibaba Spanchat And Uber Startup Quick Visualized Startup Stories Entrepreneurship Startups Start Up

Impossible Foods Signals Australia New Zealand Market Entry Amid Ipo Buzz

On May 2 2019 The Best Performing First Day Ipo In Almost 20 Years Took Place Beyondmeat S Success Showc Plant Based Recipes Plant Based Burgers Base Foods

Impossible Foods Ipo Possible Scam Ozbargain Forums

Impossible Foods Ready To Launch And Disrupt In Australia Ahead Of 10 Billion Ipo Vegconomist The Vegan Business Magazine

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo